A tendency to deregulations starts to develop in 1985 and in this very moment the Enron is founded. Not only he but other participants of a power and energy business share this outlook. In other words, he involves in the idea of deregulations. He convinces that government is not a solution but a problem to the business. Ken Lay wants to change a market of power and energy. Probably, his background plays an integral role in having huge ambitions to make wealth of him. Order custom essay Summary of the Film The Smartest Guys in the Room His father is a Baptist minister and their life is rather poor.

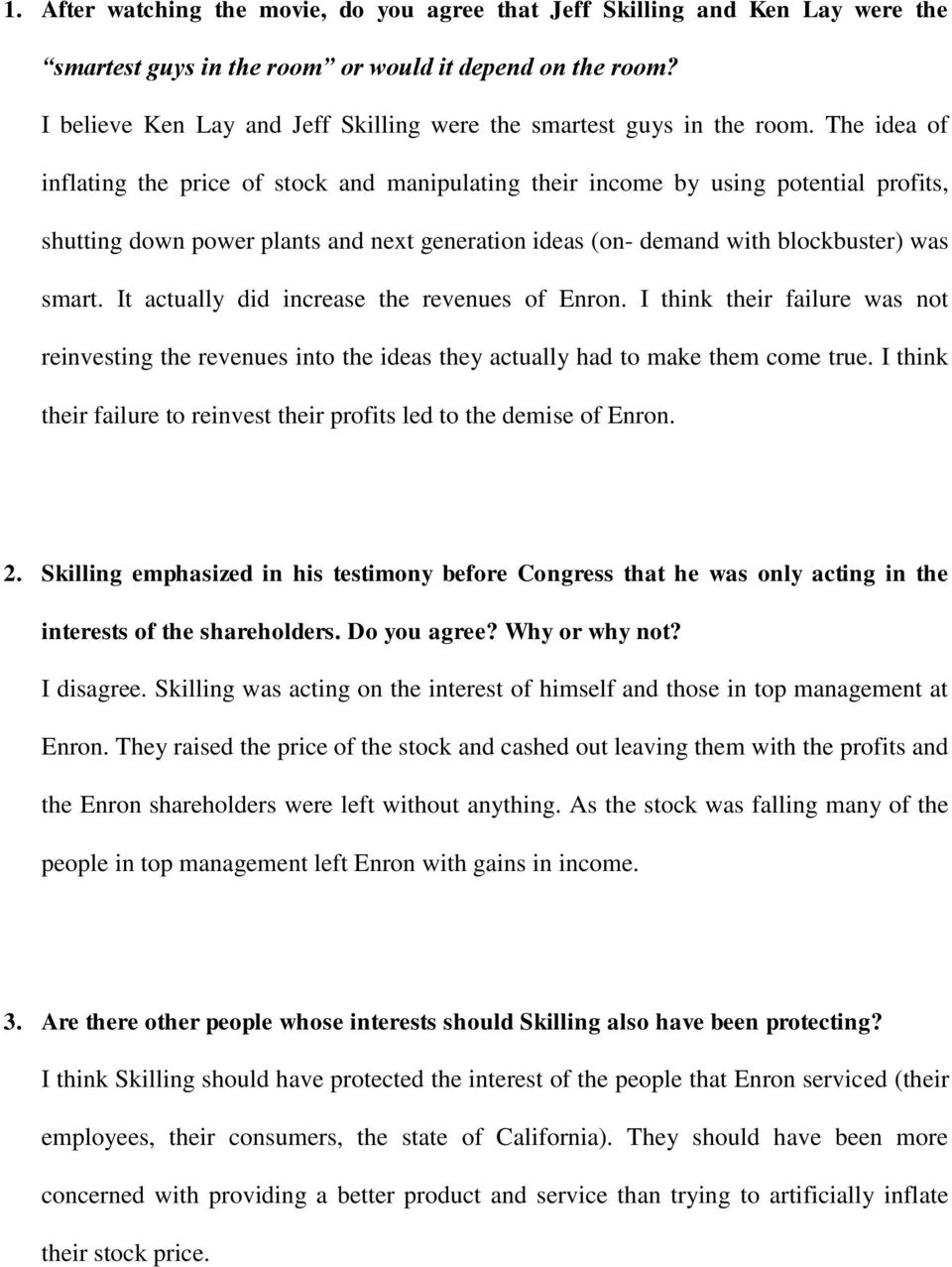

But how it starts? It starts with Ken Lay, who comes to the story of Enron from humble roots. It is an innovative business with absolutely new business model. It is a seventh largest corporation in America, valued 70 billion $. After this crucial episode, viewers come to the best years of the Enron. And it was a conviction of the fraud that was happened. The first seconds of the film represent an end of it: John Cliff Baxter committed a suicide, being heartbroken with what was happened. But the beginning of this story is bright and ambitious.Įnron represents a company of great promise. Working in a field of energy and power, having reputation of ‘unsinkable’ ship and demonstrating fascinating financial results, Enron dramatically collapsed almost in a day. From the beginning of the film it is clearly stated that the Enron case is exceptional.

The film ‘Enron: The Smartest Guys In The Room’ tries to answer the questions that all people somehow connected with the business world were interested in: How it could happened? What are the reasons and who is responsible for that? The film tries to lift the veil. Specialties were retold and discussed by analytics. For a long time sequence of events was a basis for articles and books, documental films and analytic researches. But a chain of events lead to an enormous shock on the Wall Street and went down in history as one of the biggest business scandals. When all of the lineman’s buddies were throwing their entire 401k into the company stock, its no surprise that an uneducated investor followed the crowd - and got burned.‘Enron: The Smartest Guys In The Room’ Frauds and financial scandals in the business world were before an Enron’s case and will be after it. We live in a world with almost zero financial education. If something seems too good to be true, it is.īut at the same time, I can’t help but feel sorry for the guy. That’s why I think empowering people to make smart financial choices is crucial. Yes, the lineman’s 401k allocation is his own responsibility. By the time the company collapsed, his 401k dwindled to $1,200. At its peak, his 401k was worth more than $300,000. Two weeks later, Merrill Lynch allegedly received two deals from Enron worth $50 million dollars.Īt other times, the documentary made me sad, particularly when the filmmakers interviewed an electrical lineman - a guy who hangs power lines - who placed his entire 401k in Enron stock. Merrill Lynch fired the analyst, according to the film. The film discussed one Merrill Lynch analyst who publicly questioned the “strong buy” recommendation that every other analyst was issuing.

0 kommentar(er)

0 kommentar(er)